Breaking News

Breaking News

Bilingual Consulting: Accounting with a growth mindset and tax solutions that work for you.

Are you paying more taxes than you should?

I'm Catalina Zaldana, EA, and I use the tax code to help keep your business profits where they belong — with you.

Many entrepreneurs and small business owners work tirelessly to grow their businesses, only to find that a significant portion of their income ends up in the hands of the IRS at the end of the year. But it doesn’t have to be that way.

As an Enrolled Agent authorized by the IRS, I specialize in identifying legal and personalized strategies to reduce your tax burden, optimize your finances, and help you make smarter decisions.

This isn’t just about filing your taxes — it’s about understanding how the system works and using it to your advantage. Because your hard work deserves real, lasting results.

Stop working for the IRS. Start working for your future.

Start date August 13, 2025

Learn to prepare taxes with confidence

Online Tax Preparation Course

Turn your skills into income with our hands-on expert-led course.

Master tax preparation with expert bilingual support and real-life case studies.

Why Choose Bilingual Consulting?

Whether you need accounting, tax, business consulting, insurance, or professional translation services, we are here to provide solutions tailored to your business and local needs in Carmel, Fishers, Noblesville, Indianapolis, and Westfield.

Personalized Attention

Market Experience

Flexibility and Convenience

Network of Expert Accountants

Bilingual Services

At Bilingual Consulting

we are a trusted partner offering comprehensive tax and financial services, with a strong focus on professionalism and personalized solutions for both individuals and businesses. We specialize in tax preparation, amended returns, ITIN applications and renewal, and business tax strategies for LLCs, partnerships, and S Corporations. Our services include payroll management, IRS audit representation, and tax compliance. With a commitment to professionalism, we build trusted relationships, empowering our clients through educational workshops and personalized guidance to make informed financial decisions for long-term success.

ITIN Application and Renewal Service

Need an ITIN quickly and securely? At Bilingual Consulting, we offer a convenient, fast, and reliable service. As Certified Acceptance Agents (CAA), we verify your documents on-site, so you don’t have to mail originals to the IRS. Our team will guide you through every step of the application process.

In-Person Meeting: Bring your documents to our office.

Verification: We review and complete your W-7 form.

Secure Submission: We send your application directly to the IRS.

-

If settling your taxes in full is a challenge, consider a flexible payment plan. This option allows you to gradually pay off your taxes, with a pause on collection actions even as fines and interest accrue.

-

In situations where the IRS questions its ability to collect the entire debt, Bilingual Consulting may negotiate to reduce your tax burden. While the Offer in Compromise process is time-consuming, it could lead to substantial savings.

-

If your business is grappling with severe financial issues, Bilingual Consulting might help suspend the collection of overdue taxes by categorizing your case as “currently not collectible.” Once your financial standing improves, you can work out a payment plan with the IRS to address outstanding tax matters.

-

-Representation under Power of Attorney (POA)

-Thorough Business Evaluation

-Response filing and negotiation during a Tax Audit

-Review and Filing of Tax Return Amendments (if necessary)

-Consultation on Tax Debt Resolution

Tax Debt Solutions Offered by Bilingual Consulting

Effective Financial Practices for Business Success

Maintain detailed records, use accounting software, separate finances. Consult Bilingual Consulting for tax guidance. Reconcile accounts, secure documents, monitor cash flow for business success.

Resolution of Tax Debt for Small Businesses

Do you owe money to the IRS? Our tax debt resolution services can help you refocus on your business.

Accounting and Tax Services

Accounting | Bookkeeping

Comprehensive management of your company’s finances, ensuring accuracy and compliance with accounting standards. Detailed recording of daily financial transactions to keep your business organized and audit-ready.

Payroll

Complete payroll administration, ensuring your employees are paid on time and accurately

Tax Preparation

Professional tax preparation to maximize deductions and minimize tax liabilities

ITIN CAA Office

Assistance with sales tax filing and compliance to avoid penalties and ensure tax compliance.

Sales tax

Assistance with sales tax filing and compliance to avoid penalties and ensure tax compliance.

Inventory Management

Solutions for efficient inventory management, ensuring your business operates with optimal stock levels.

Tax Planning

Personalized strategies to optimize tax planning and enhance long-term financial efficiency.

Consulting and Business Services

Consulting

Expert advice to improve your business's efficiency, profitability, and structure.

Business Incorporation

Comprehensive services for forming new businesses, from selecting the appropriate structure to filing legal documents.

Business Licenses

Assistance in obtaining and renewing the necessary business licenses to ensure compliance with local and state regulations.

Business Entity Report

Preparation and filing of annual business entity reports to maintain your business’s good standing with the state.

Insurance and Compliance Services

Insurance

Customized insurance coverage to protect your business against risks and ensure its continuity in case of unforeseen events.

Cyber Liability

Protection against cyber risks, including data breaches and cyber-attacks, that could impact your business’s integrity.

Additional services

Translation

Accurate and confidential translation of legal, personal, and business documents. We adapt your message to both languages.

Ministry

We offer support for various life events, including ceremonies, counseling, and community guidance.

Notaries

We provide professional notarization for legal documents, contracts, powers of attorney, and more. Confidentiality and accuracy guaranteed.

IRS Representation & Tax Debt Resolution

Ana Culwell/ Accountant

Millicent Dotson/ CPA

Areli Gomez/ Tax Preparer and Public Notary

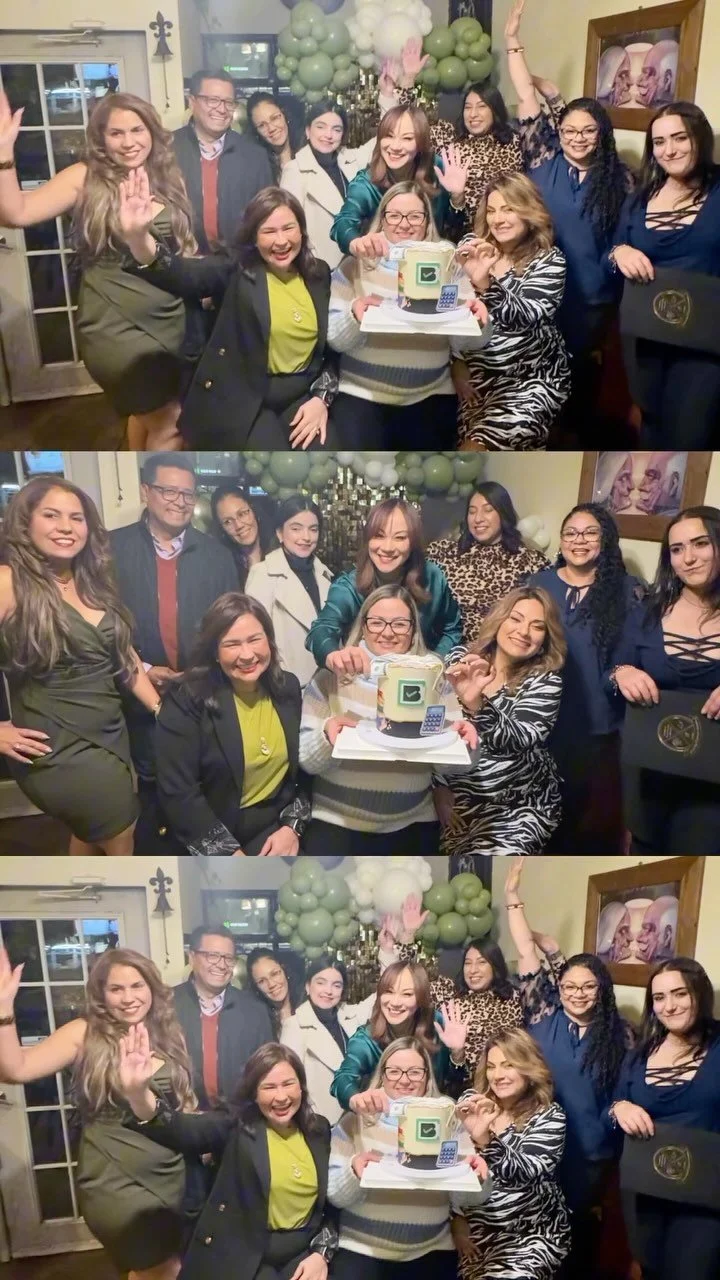

Meet our Team

Catalina Zaldana, EA

Founder & CEO Bilingual Consulting

-

Mitchell Carrero

Office Manager

-

Ana Culwell

Accountant

-

Millicent Dotson

CPA Certified Public Accountant

-

Areli Gomez

Senior Tax Preparer, Ministry, Public Notary

-

Zulyle Martinez

Payroll Operations Manager

-

Paola Navas

Junior Accountant & Tax Professional

-

Elvia Ochoa

Senior Accountant

-

Benjamin Zaldana

Payroll Clerk

FAQs

-

We offer a wide range of accounting services, including general accounting, tax advisory, audits, financial consulting, and payroll management. Our team of public accountants works virtually to efficiently and personally meet your financial needs.

-

The Bilingual Consulting team will guide you throughout the entire ITIN application process using IRS Form W-7. This form requires documentation to verify your identity and foreign status. Our goal is to ensure that you complete the application correctly and submit it to the IRS for approval.

-

To ensure your tax return is completed accurately, our team will request essential documents such as income forms (W-2, 1099), valid identification (such as your passport), and any other relevant documents that may affect your deductions and tax credits. We ensure all information is up-to-date and compliant with tax regulations.

-

If you receive correspondence from the IRS, we recommend that you contact our team immediately by calling (317) 200-3169. We will review the letter to understand the nature of the issue and guide you through the next steps. We handle any direct communication with the IRS, so you don’t have to face it alone.

-

We implement strict security measures to protect the confidentiality of your data. We use advanced encryption technologies and follow industry best practices to ensure the security of your financial information.

-

If errors are detected in a previously filed tax return, the Bilingual Consulting team will assist you in preparing an amendment using IRS Form 1040X. This process is critical to correcting any mistakes and ensuring your tax records are accurate. Throughout the process, we will provide you with the necessary support to ensure the corrections are recognized by the IRS promptly.

-

You can obtain a personalized insurance quote by contacting us at (317) 200-3169 or through our website. Our team will assess your specific needs and offer the best option to protect your business or personal assets. We strive to provide you with affordable and comprehensive solutions for your business's financial security.

-

Once a payment agreement is established with the IRS, automatic debits typically take 30 to 60 days to process. If you notice delays or irregularities in payments, contact us at (317) 200-3169 so we can review the status of your account and, if necessary, intervene on your behalf with the IRS.

-

At Bilingual Consulting, we specialize in detecting and correcting accounting errors or discrepancies. We conduct thorough reviews to identify inconsistencies and ensure that your reports comply with regulations. Our team also provides guidance to help prevent recurring errors and optimize the accuracy of your accounting.

Great Google Reviews… Thank You!

Thank you to our customers!

“Working with Bilingual Consulting has been a wonderful experience. They have greatly helped us with the organization of our monthly accounting and our taxes. Thanks to their support, we now operate not only in the state of Florida but also in the state of Indiana. Catalina and the entire team at Bilingual Consulting have provided exceptional service, and we wholeheartedly recommend them. You are in very good hands”.

Stacy Bejarano, Prestigio Realty

"Good afternoon, my name is Alejandro Hernández from La Canasta store. I highly recommend Bilingual Consulting and their team for all types of accounting. They are very good and we are very satisfied."

Alejandro Hernandez, Tienda La Canasta

"Hello, my name is Neudymar Pina. I am the owner of Amazing 360 Cleaning Services. Bilingual Consulting is currently handling all our tax matters and the accounting of my company. They organize everything related to accounting and tax matters. My experience with them has been excellent, first-rate. Both Catalina and the team have always been ready to go above and beyond and provide guidance with any doubts I have. I highly recommend them. If you have any business ideas, questions, or need knowledge to start a business, don't hesitate to come to Bilingual Consulting. The first step is the most difficult and important, but with their team, you will have no problems. They will help you in all aspects, accounting, legal, and financial, to ensure your business develops well."

Neudymar Pina, Amazing 360 Cleaning Services

“Nice to meet you, my name is Carlos Hernández, originally from Colombia. It's a pleasure to be here sharing our experience. It has been quite interesting. We started our journey with them three years ago, and it has been fabulous. They have greatly organized our businesses and also our personal finances. I can't recommend their company enough. Their personalized and specialized service makes it very easy to handle the financial area, which is complicated for everyone in this country. They help us stay calm and trust that there is someone managing our finances without any issues”.

Carlos Hernandez

"Hello, my name is Paola Petit. I am from Cabimas, Zulia, Venezuela. With Bilingual Consulting, I have had the best experiences. They have managed to expand my business, handle my accounting, and maintain order. They are extremely reliable."

Paola Petit, Paola Petit Studio

Breaking news

Follow us on Instagram!

Ready to Get Started?

Contact us for an initial consultation. Our clients represent many industries, including: Restaurants, Beauty Salons, Boutiques, Construction and Remodeling, Landscaping, Staffing.